Recession Resilient Asset Class

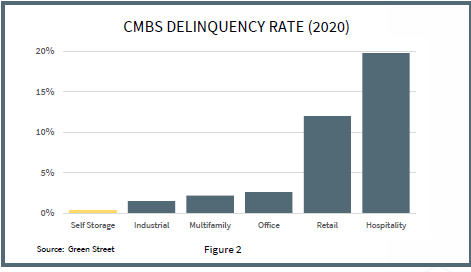

During the Great Financial Crisis, all commercial real estate segments experienced a net annual loss of anywhere between 25 to 67% except self storage, which posted a gain of 5% in 2008. Similarly, during the dot-com bubble self storage REITs saw meaningful gains while the 500 suffered. Between January of 2000 and September of 2002, the S&P 500 dropped 55% while the self storage REIT index increased by more than 60% due to its recession resilient qualities that make it an attractive hedge against bear markets.

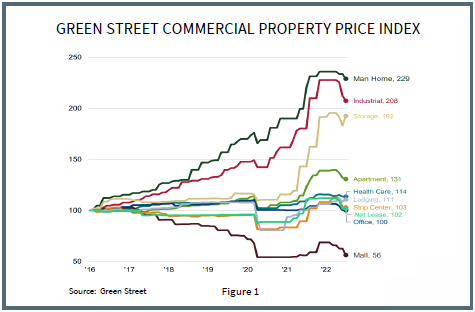

The storage sector showed its resilience again during COVID with significant value outperformance, strong occupancy and rental rate growth, and very low loan delinquency across the asset class, as illustrated in Figure 2. Self storage benefits from a well-balanced mixture of demand drivers - during economically prosperous times, customers have excess disposable income to accumulate and store more belongings, and during times of economic downcycle, forced relocations, home downsizing, increased tendency to rent instead of own, and other disruptive factors keep demand for storage and achieved rental rates strong.

Self Storage Sector Outperformance

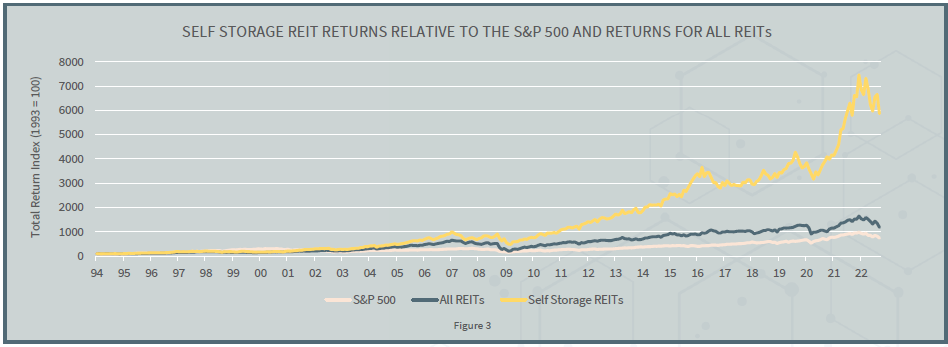

Over the last three decades, the REIT sector as a whole has meaningfully outperformed the S&P 500 due to its generally reduced volatility, favorable tax structure, strong cash flow distributions, and pattern of moderate long-term capital appreciation. Over the same time period, self storage has meaningfully outperformed both the S&P 500 and all other REITs. Self storage has been and continues to be propelled by its resiliency, inflation hedged characteristics, low cap ex requirements, solid profit margins, and steady cash flow. Over the last 15 years, the self storage sector has also benefitted from a major influx of large institutional sources of capital with an appetite to make storage a meaningful part of their portfolio. This demand has and continues to significantly outweigh the supply of acquisition opportunities, leading to rapid value appreciation.